Top 8 Worst Real Estate Deals on Record

Warning: Use of undefined constant user_level - assumed 'user_level' (this will throw an Error in a future version of PHP) in /home/zzgspc5zic0z/domains/findthecapital.com/html/wp-content/plugins/ultimate-google-analytics/ultimate_ga.php on line 524

Article by, Find the Capital

Bad real estate investments are a given. Even pros make errors and encounter unforeseen circumstances. Here are 8 of some of the most public, bizarre and plain raw real estate investment deals:

1. Bad Investment Decision Combined with Market Slump Bodes the End for High Profile Developer

In the late 1980s Olympia and York was arguably one of the most powerful private real estate developers in the world. The company was divided in its trophy properties: half in North America, half in London. The London half of the company’s holdings was in the developing Canary Wharf district, a high profile and costly public-private renovation project.

- Canary Wharf was originally one of the most vital ports in Europe and key to early Canary Islands trade, thus the name of the wharf. Prior to the 20 th century ships were smaller, more nimble and had no problem negotiating the Canary Wharf. The port became completely unsuitable for modern ships.

- During the mid 20 th century, Canary Wharf became a maritime ghost town, left to ruin, a huge bust for the London economy and business landscape.

London docklands intended boom:

In the late 80s a partnership between London government and private investors signaled a plan to revitalize the London Docklands, or Canary Wharf. The goal: remake it into one of the most powerful business districts in the world. Enter Olympia and York: the company would be a key mover and shaker in the district, and help attract and net other powerful developers with notoriety and cash to invest.

What in theory was a great real estate investment for Olympia and York, as well as hundreds of others, was undone by a one-two industry punch: the slump in the U.S. real estate market followed by a hard slump in the London market.

- First the U.S. real estate market slumped, when that happened Olympia and York was reportedly immediately crunched for cash between its New York and Canadian holdings and the unnerving costs for construction on its Canary Wharf project.

- In a strategic and hush-hush move the company unloaded a surprising number of its New York and Canadian properties in the early 90s. Why? The company needed to put all its assets into the Canary Wharf project in order to survive the market gyrations. The deal was not a wise one: by 1992 Olympia and York had collapsed and ultimately declared bankruptcy.

What went wrong for Olympia and York?

In hindsight Olympia and York placed huge bets on multiple high dollar real estate investments in two rapidly falling markets without imagining the fall-out from such sudden dives.

2. The One Great Worst Las Vegas Real Estate Deal

Las Vegas is symbolic of one of the most innovative land uses in history: a plot of desert in the middle of hot and arid Nevada devoted exclusively to high stakes gambling and no-expenses-spared resort casinos. Who could lose in that game? From our perspective now it’s obvious that Las Vegas property on any scale was an absolute great investment. Even small time homeowners own a real estate gem. But for one particular high profile Las Vegas investor, a real estate deal turned deadly:

As a thug, Bugsy Siegel excelled. He was one of the Mafia’s most notorious and violent gangsters; very effective at his job. As a real estate developer he failed miserably due to a variety of factors:

- Bugsy Siegel assumed development on a floundering hotel construction in the new Las Vegas territory during the 1940s.

- He sunk millions of dollars into the project, much of it borrowed directly from the Mob.

- One of his biggest mistakes was his assumption that he was capable of managing a construction development project, protecting the assets. According to his records he never would have ended up in the hole for nearly the amount of money had he the skills needed of a good developer.

- At that time the hotel, named the Flamingo, was such a design departure from the other hotels in the area. Consequently his mob partners doubted the venture’s success from the start.

- The Flamingo’s eagerly anticipated grand opening failed to net the return on investment needed to repay Siegel’s Mob debts.

- Ultimately his bad business dealings cost him his life not long after the Flamingo had debuted.

The real irony in the Bugsy Siegel real estate investment saga: Siegel was right on with his high-end, no-expenses-spared Havana-inspired casino resort concept. His general concept is that upon which all of Las Vegas’s success is based today.

3. The Bizarre Oak Island Money Pit – Negative Cash Flow Over and Over

The famous Oak Island real estate deal is cloaked in pirate tales and buried treasure, big incentives for rich investors with wild imaginations and money to burn, but not very practical. Truth is many a real estate investment in history has been struck over the shear possibility of riches, be it treasure, lost mines, or mineral deposits.

The famous Oak Island real estate deal is cloaked in pirate tales and buried treasure, big incentives for rich investors with wild imaginations and money to burn, but not very practical. Truth is many a real estate investment in history has been struck over the shear possibility of riches, be it treasure, lost mines, or mineral deposits.

For over 200 years the legendary acreage known as Oak Island off the coast of Nova Scotia has been bought and sold and bought and sold many times over. The alleged treasure continues to sit far under the earth in a purported maze of traps and shafts that apparently are so ingenious even the most savvy and wealthy of investors is stumped. 3 Each sale symbolizes bankruptcy and failure and each purchase portends of financial riches.

What makes Oak Island one of the worst investments?

So far any investor who’s put cash into Oak Island has lost a fortune. The property has been the reverse of most ideal real estate investments: a loser, a negative cash flow from the very first shovel-full of dirt. Most successful real estate investors look for holdings with a predictable cash flow upward.

Should Oak Island ever surrender its reported riches the investor holding this stake will make a killing. In the meantime this property deal remains one of the most infamous and bizarre real estate losers in history.

4. Rockefeller Center: Trojan Horse Deal

In the late 80s most of the investment holdings in Rockefeller Center in New York were sold to Mitsubishi Estate Company. The sale was recorded at $1.4 billion, twice what a competing Japanese bidder was willing to pay. The price was paid only because the bid was for the world renowned Rockefeller Center.

Details of the raw Rockefeller Center deal:

- The sale was in reality a way for the Rockefeller family to save their family namesake from the real estate dumper. Manhattan office space was in a hard real estate slump and more money was going out than coming in.

- Mitsubishi Estate Company believed its investment to be a rock solid international buy, a cash flow property, a key holding that would expand the company’s growing global trophy properties.

- In reality, Mitsubishi, traded well over a billion dollars for a complex of historically intriguing properties, yes, but with dwindling renters, and devastating financial debt trailing along in the dust.

- Other big losers in the Rockefeller deal were the investors from large to small that actually bought into the REIT in the mid-80s, another Rockefeller ploy to shore up a loser real estate investment and keep the family in the black.

The nitty gritty of the Rockefeller Center investment from day one to the present: despite the historic and architectural significance of this property, Rockefeller Center has produced unremarkable profit. 6 Its saving grace has been its family name and New York City fame.

Ironically Tishman Speyer Properties bought Rockefeller Center outright for $1.85 billion in 2001 7 and went on to be a key player in some of the best real estate investment deals to date.

5. Rich Silicon Valley, Poor Silicon Valley

![]()

Silicon Valley in California had a Jekyll and Hyde personality, from boom to bust. The tech bubble was perhaps the number one road sign indicating that even a tough tech economy could be brought to its knees when faced with a frenzy of unwise business investments. At the same time the Dot Com companies were establishing tech and online real estate most also bought up tracts of rich Valley territory on which to build their imagined corporate empires.

Real estate-speaking the burst in the Valley could just as well have been an atomic bomb blast.Buildings sat vacant for years, office rents plummeted and companies lost fortunes that had only existed on paper. For dozens of companies the real estate investment online and offline was ruinous.

- Physical real estate deals had happened for the worst, and in one of the most disastrous “bubbles” of modern time.

- Only recently has Silicon Valley begun to experience re-growth. Even new business is checked and without impulse.

6. Extraterrestrial Real Estate For Sale: Affordable Acreage

Some international real estate is risky enough, but the more bizarre real estate investment choice: buying acreage on the moon–the moon up in the sky at night, yes. In 1980 Lunar Embassy hung its shingle and has since then marketed astral acreage. Buy moon property for an affordable $37 per acre. Lunar Embassy boasts a few million buyers and over 300 million acres sold. The legitimacy of the property ownership remains hotly contested, but the company not only offers it for novelty but “potential prudent investment.”

Lunar real estate facts:

- Lunar Embassy is not the only extraterrestrial real estate agency in the business to make a killing on people’s bad investment decisions.

- Worried about acreage running out? The surface of the moon is covered with 9 billion acres of rock and lunar dust.

- The Outer Space Treaty signed in 1967 was designed to establish a system of regulations and laws pertaining to the use of extraterrestrial land. The treaty explicitly forbids any sovereign nation from private property ownership.

Novelty or frenzy, $37 is hard, cold cash and any real estate investment for extraterrestrial property is impractical at best. Even if the sales were legitimate, who exactly is policing the pell-mell sale of acreage located on a rock 384,000 km away? When can our ancestors move in?

Save your money.

7. For Sale: Toxic Dump Acreage

Donald Trump in late 2007 advertised his partnership with a golf course development company. Their project: to refurbish acres of land fill in New Jersey and create mixed use property, specifically pristine golf courses and residential neighborhoods.

Why this deal became a stinker:

- The deal set aside money for site cleanup, or brownfield site development.

- EnCap, the cleanup developer that ultimately won the project bid, proved itself completely inept and totally bungled a rather high-profile job. The company literally worsened the filth of the area, if that’s possible, and when slapped with millions of dollars in fines for its errors, ended up in a financial sink-hole.

- So much local and environmental flap has ensued that the project took a predictable nose-dive.

Who wants to play golf or live on land that sits above toxic garbage? Would any other investor even bother considering the deal? Bad deal, by one of the most storied real estate developers/entrepreneurs of all time.

8. From Boom to Bust: Real Estate Between 2005 and 2008

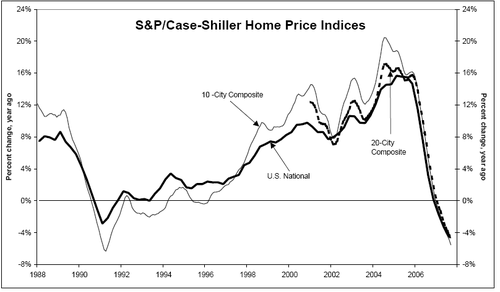

Remember back in 2005, when everyone even tangentially associated with real estate and investments was on a cash-flow high? Optimism skyrocketed. Interest-only loans, no money down and other quickly cobbled financial fabrications put millions of Americans into home deals in which they had no real business being involved and unwittingly in cahoots with a great many lenders that had become too-big-for-their-britches. “The Trillion-Dollar Bet,” is what the New York Times called it in June 2005.

- During 2005 over 26% of all home loans were interest-only and an additional 15%+ were option-ARMS 12, a fancy way of saying, “You can pay us what you can manage each month–until we need exponentially more, of course.” That brings impractical loans made in 2005 to over 40%, close enough to half to be frightening, particularly in hindsight.

- Rapid expansion in structured investment vehicles (SIV: a tricky, off-the-balance-sheet investment tool) played a critical role in the ensuing credit market crunch. In mid-2007 when the actual value (or lack of value) of subprime mortgages was revealed, the losses literally brought a number of national and international investment banks to their knees. The instability led to credit line shut-downs and an asset-backed commercial paper (CP) crisis of a global magnitude.

- During 2007 foreclosures increased to record levels—1.3 million for the year 13 alone –and hit a breakneck pace during the final quarter. A breathtaking 20%+ home price free-fall dominated the news for the last two months of 2007, as well.

- It’s mid-2008: Despite the global financial repercussions of the industry meltdown, and the millions of Americans for whom the dreams of homeownership led them to the single worst financial investments of their lives, the RE investment bottom has not even been realized.

“Looking for Joint Venture Capital Providers that Focus Just on Real Estate?”

No longer to you need to sift through those difficult to navigate Venture Capital provider lists looking for Real Estate Capital… Check out this FREE Video on who is putting JV Capital out for Real Estate!